VA VA-8879 2022 free printable template

Show details

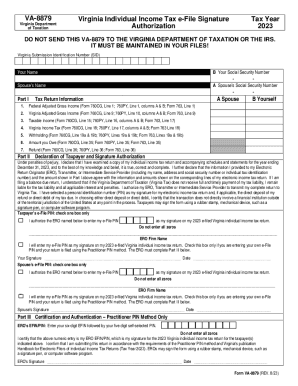

VA8879 Virginia Department of Taxation Virginia Individual Income Tax file Signature Authorization Year 2022DO NOT SEND THIS VA8879 TO THE VIRGINIA DEPARTMENT OF TAXATION OR THE IRS. IT MUST BE MAINTAINED

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your va 8879 2022 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va 8879 2022 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit va 8879 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit virginia va 8879 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

VA VA-8879 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out va 8879 2022 form

How to fill out va 8879:

01

Obtain a copy of va 8879 form from the respective authority or website.

02

Carefully read the instructions provided on the form to understand the requirements and guidelines.

03

Fill in the necessary personal information, such as your name, Social Security number, and address.

04

Include relevant financial information, such as income, deductions, and credits accurately and to the best of your knowledge.

05

Make sure to double-check all the entered information for any errors or omissions.

06

Sign and date the form as required. If filing jointly, ensure your spouse also signs the form.

07

Keep a copy of the filled-out va 8879 form for your records.

Who needs va 8879:

01

Individuals who have tax obligations and need to file their federal income tax return.

02

Businesses and self-employed individuals who are required to report their income and expenses.

03

Taxpayers who file electronically and are instructed by their tax preparer or software to submit va 8879 as an acknowledgment of their tax return.

Fill va 8879 type : Try Risk Free

People Also Ask about va 8879

What is the difference between 1040 form and 8879?

Who files IRS form 8879?

Does the IRS accept electronic signatures on form 8879 C?

What is form 8879 C used for?

Is form 8879 proof of income?

Do I need to file form 8879?

Is 8878 required?

Is 8879 required?

Is tax form 8879 the same as 1040?

Who fills out form 8879?

Is the tax form 8879 the same as 1040?

Is form 8879 required?

What is form VA 8879?

What is C notice from IRS?

Who must file form 8879?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is va 8879?

VA 8879 is a form used to report the total amount of tax payments made by an individual filer to the Internal Revenue Service (IRS).

Who is required to file va 8879?

Form VA 8879 is typically used by taxpayers who are filing a Virginia income tax return. All individuals who are filing a Virginia income tax return must complete and submit Form VA 8879.

What is the purpose of va 8879?

VA Form 8879 is an Income Tax Declaration for Electronic Filing used by veterans and their dependents who are filing a federal income tax return electronically using Department of Veterans Affairs (VA) software. The form is used to certify that the taxpayer is authorized to electronically file a return and that the taxpayer's identity has been verified.

When is the deadline to file va 8879 in 2023?

The deadline to file VA Form 8879 in 2023 has not yet been announced. The VA generally announces the annual filing deadline in the spring of the preceding year. You can check the VA website for updates and more information.

What is the penalty for the late filing of va 8879?

There is no specific penalty for late filing of VA Form 8879, but filing the form after the due date may result in late payment penalties, interest charges, and other penalties from the Internal Revenue Service.

How to fill out va 8879?

To fill out Form VA 8879, follow these steps:

1. Provide your Personal Information:

- Enter your name and Taxpayer Identification Number (TIN) in the designated fields.

- If you are filing as a couple, enter your spouse's name and TIN as well.

2. Verify ERO and firm information:

- Enter your Electronic Return Originator (ERO) information, including name, EFIN (Electronic Filing Identification Number), firm name, address, and contact information.

3. Indicate the tax return period:

- Specify the tax year or period for which you are filing the return.

4. Review and sign Form 8879:

- Confirm that you have reviewed the completed return and that all information is accurate.

- Sign and date the form.

- If filing jointly, both taxpayers must sign and date the form.

5. ERO authentication information:

- Provide ERO authentication information as required. This may include the ERO's assigned 5-digit Personal Identification Number (PIN).

6. Return instructions and contact information:

- Include any instructions or additional contact information if necessary.

7. Retain a copy:

- Make a copy of the completed Form 8879 for your records.

Note that this is a general guide to filling out Form VA 8879, and specific instructions may vary depending on your tax situation. It is advisable to consult with a tax professional or the IRS for exact guidelines.

What information must be reported on va 8879?

Form VA 8879 is an IRS e-file Signature Authorization form used by taxpayers and tax professionals to authorize the electronic filing of federal income tax returns. It is not specific to any particular type of tax return, but rather a general form used for authorization purposes.

The information that must be reported on Form VA 8879 includes:

1. Taxpayer's Identification Information: The form requires the taxpayer's name, Social Security number (or other taxpayer identification number), address, and phone number.

2. Tax Preparer's Information: The form also requires the tax preparer's name, firm name (if applicable), address, and phone number.

3. Electronic Filing Information: The form asks for the electronic filing option selected (e.g., self-prepared or tax professional prepared), the type of return being filed (e.g., individual, partnership, corporation, etc.), and the tax year being reported.

4. Authorization: The taxpayer authorizes the tax preparer to electronically transmit the taxpayer's tax return to the IRS for processing and acknowledge that they have reviewed the completed return before signing. The taxpayer also certifies that they are the person identified on the form and that they are authorized to sign the return.

5. Signatures: The taxpayer and tax preparer must sign and date the form to certify its accuracy and completeness.

It is essential to note that the specific information required on Form VA 8879 may vary depending on the tax software or tax professional using the form. It is recommended to consult with a tax professional or refer to the IRS instructions for Form VA 8879 for any specific requirements or updates.

Where do I find va 8879?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific virginia va 8879 form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit va 8879 form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your va va 8879 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out virginia income authorization on an Android device?

Complete your virginia e file form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your va 8879 2022 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va 8879 Form is not the form you're looking for?Search for another form here.

Keywords relevant to va 8879 tax form

Related to 2022 va 8879

If you believe that this page should be taken down, please follow our DMCA take down process

here

.